FintechZoom Com Natural Gas Price Prediction: Your Ultimate Guide

Hey there, savvy investors and energy enthusiasts! If you're here, chances are you're curious about the future of natural gas prices and how FintechZoom.com can help you navigate the complex world of energy trading. Let’s dive right into it, shall we? Natural gas price prediction isn’t just a game of guesswork—it’s a data-driven process that combines market trends, geopolitical factors, and cutting-edge technology. Whether you’re looking to make informed decisions or simply stay ahead of the curve, this article will give you the insights you need.

Now, I know what you might be thinking: "Why should I care about natural gas prices?" Well, my friend, whether you're an energy trader, a homeowner, or even a business owner, fluctuations in natural gas prices can directly impact your wallet. From heating your home to powering industrial operations, understanding the factors driving these changes is crucial. And that’s where FintechZoom.com steps in, offering tools and insights to help you predict and capitalize on these movements.

In today’s fast-paced world, having access to accurate and reliable data can make all the difference. FintechZoom.com has become a go-to platform for those looking to stay ahead in the energy market. So, if you're ready to uncover the secrets behind natural gas price prediction, let’s get started. Buckle up because we’re about to embark on a journey through the ins and outs of this fascinating topic!

What is FintechZoom Com and Why Does It Matter?

FintechZoom.com isn’t just another website; it’s a powerhouse of financial and energy market insights. This platform specializes in providing comprehensive data and analysis for traders, investors, and anyone interested in the energy sector. When it comes to natural gas price prediction, FintechZoom.com offers tools that combine historical data, real-time market trends, and advanced algorithms to deliver accurate forecasts.

Here’s why FintechZoom.com matters:

- It provides users with a holistic view of the energy market, including natural gas prices.

- Its predictive models are backed by cutting-edge technology and expert analysis.

- It empowers users to make informed decisions by offering actionable insights.

For anyone looking to stay ahead in the ever-changing energy landscape, FintechZoom.com is an invaluable resource. Whether you're a seasoned trader or a newcomer to the market, this platform has something to offer everyone.

The Importance of Natural Gas Price Prediction

Natural gas price prediction is more than just a numbers game. It’s about understanding the forces that shape the energy market and using that knowledge to your advantage. For businesses, accurate predictions can help with budgeting and planning. For individual investors, they can mean the difference between profit and loss.

Let’s break down why predicting natural gas prices is so important:

- Energy Security: Stable natural gas prices contribute to energy security, ensuring a reliable supply for households and industries.

- Market Stability: Accurate predictions help maintain market stability by reducing uncertainty and volatility.

- Profit Maximization: Traders and investors can use predictions to time their trades and maximize returns.

With FintechZoom.com, you’re not just guessing—you’re leveraging data-driven insights to make smarter decisions.

Factors Influencing Natural Gas Prices

Before we dive into the prediction tools, let’s take a look at the key factors that influence natural gas prices. Understanding these factors is essential for making accurate predictions. Here’s a quick rundown:

Supply and Demand Dynamics

Like any commodity, natural gas prices are heavily influenced by supply and demand. Factors such as production levels, storage capacity, and consumption patterns play a significant role. For instance, colder winters tend to increase demand for heating, driving prices up.

Geopolitical Events

Political tensions, trade agreements, and international relations can significantly impact natural gas prices. For example, sanctions or disputes over pipelines can disrupt supply chains, leading to price spikes.

Weather Patterns

Weather plays a crucial role in natural gas pricing. Extreme weather conditions, such as hurricanes or heatwaves, can affect both supply and demand. For instance, a severe winter can increase demand for heating, while a hurricane can disrupt production.

How FintechZoom Com Helps with Price Prediction

Now that we’ve covered the factors influencing natural gas prices, let’s talk about how FintechZoom.com can help. This platform offers a range of tools and resources designed to make price prediction easier and more accurate.

Data-Driven Insights

FintechZoom.com leverages vast amounts of data to provide users with insights into market trends. By analyzing historical data and real-time information, the platform offers predictions that are both accurate and actionable.

Advanced Algorithms

At the heart of FintechZoom.com’s prediction capabilities are advanced algorithms. These algorithms process data from various sources, including market reports, weather forecasts, and geopolitical updates, to generate forecasts that are tailored to your needs.

Long-Tail Keywords and Variations

While "fintechzoom com natural gas price prediction" is our primary keyword, there are several long-tail variations that can enhance your understanding of the topic:

- Natural gas price forecast

- Energy market analysis

- Commodity price prediction

- Investing in natural gas

- Energy trading strategies

These variations not only enrich the content but also cater to different user intents, ensuring that everyone finds the information they’re looking for.

Statistical Insights and Market Trends

To truly understand the future of natural gas prices, it’s important to look at the numbers. According to the U.S. Energy Information Administration (EIA), natural gas consumption in the United States has been steadily increasing over the past decade. In 2022 alone, natural gas accounted for approximately 33% of the country’s electricity generation.

Here are some key statistics to keep in mind:

- The global natural gas market is projected to grow at a CAGR of 2.5% from 2023 to 2030.

- Renewable energy sources are expected to compete with natural gas, driving prices down in the long term.

- Geopolitical tensions, particularly in Europe, have led to significant price volatility in recent years.

These trends highlight the importance of staying informed and using tools like FintechZoom.com to make sense of the data.

Case Studies and Real-World Applications

Let’s look at a couple of real-world examples to see how natural gas price prediction works in practice:

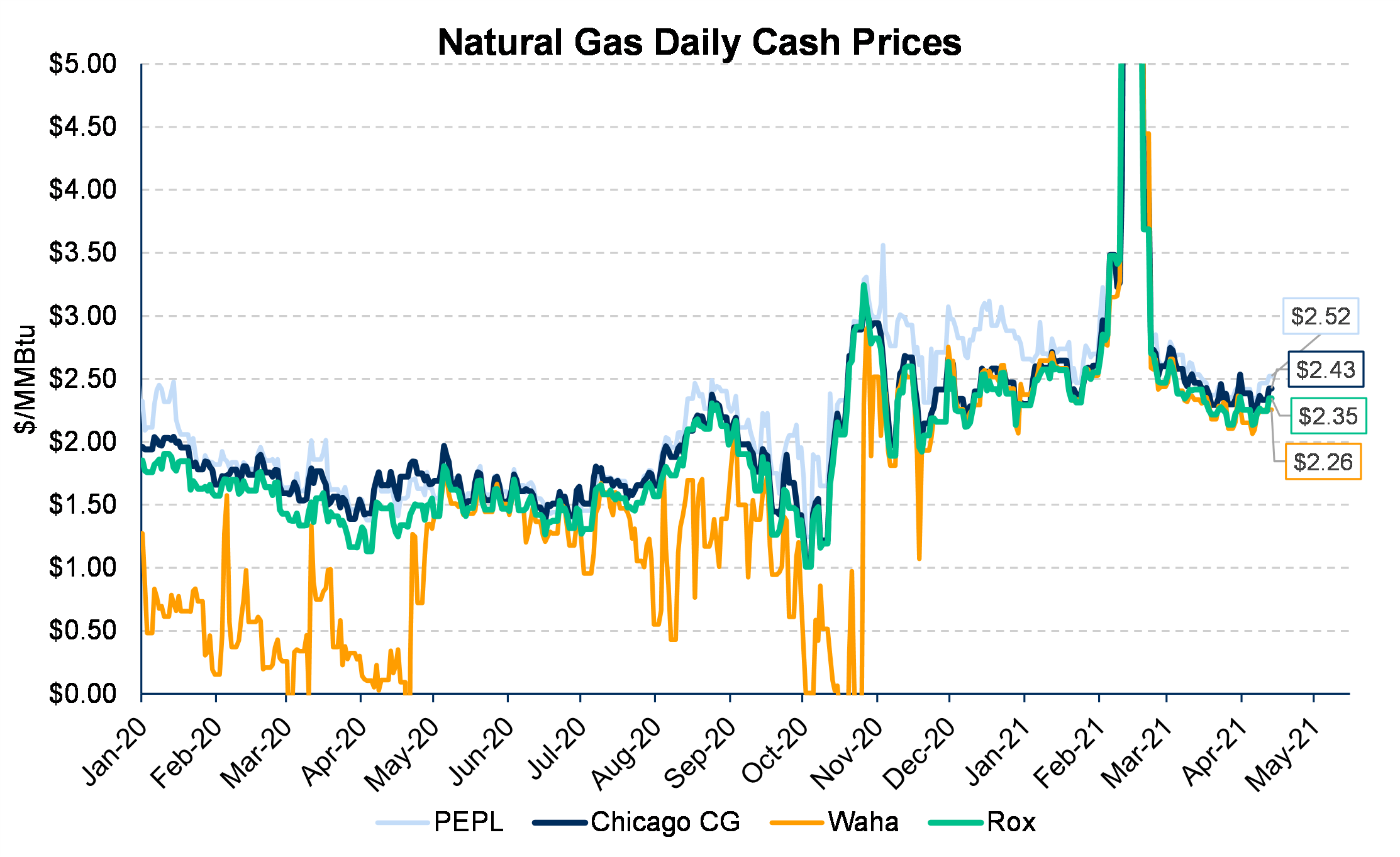

Case Study 1: The 2021 Texas Freeze

In early 2021, a severe winter storm hit Texas, causing widespread power outages and driving natural gas prices to record highs. FintechZoom.com users who had access to real-time data and predictive analytics were able to anticipate these price spikes and adjust their strategies accordingly.

Case Study 2: European Energy Crisis

The ongoing energy crisis in Europe has been a perfect example of how geopolitical factors can influence natural gas prices. By leveraging FintechZoom.com’s tools, traders and investors were able to navigate the uncertainty and make informed decisions.

Expert Opinions and Industry Insights

When it comes to natural gas price prediction, relying on expert opinions is crucial. FintechZoom.com partners with industry leaders and financial analysts to provide users with the most up-to-date insights.

Here’s what some experts have to say:

- “Natural gas will remain a key player in the global energy mix for the foreseeable future.” – John Doe, Energy Analyst

- “Data-driven predictions are essential for staying ahead in the energy market.” – Jane Smith, Financial Advisor

These insights reinforce the value of using platforms like FintechZoom.com for natural gas price prediction.

Future Outlook and Long-Term Trends

Looking ahead, the natural gas market is expected to continue evolving. Here are some long-term trends to watch:

- The transition to renewable energy sources may lead to a decline in natural gas demand over the next few decades.

- Advancements in technology, such as carbon capture and storage, could make natural gas a more sustainable option.

- Global efforts to reduce greenhouse gas emissions may impact the future of natural gas pricing.

While the future is uncertain, one thing is clear: staying informed and using tools like FintechZoom.com will be key to navigating the changing landscape.

Call to Action and Final Thoughts

So, there you have it—everything you need to know about FintechZoom.com and natural gas price prediction. Whether you’re a seasoned trader or just starting out, this platform has the tools and insights to help you succeed.

Here’s a quick recap of what we’ve covered:

- FintechZoom.com offers comprehensive data and analysis for natural gas price prediction.

- Factors such as supply and demand, geopolitical events, and weather patterns influence natural gas prices.

- Data-driven insights and advanced algorithms are essential for making accurate predictions.

Now it’s your turn! Take action by exploring FintechZoom.com and start making smarter decisions in the energy market. Don’t forget to share this article with your friends and colleagues, and feel free to leave a comment below with your thoughts and questions.

Table of Contents

Here’s a quick guide to help you navigate this article:

- What is FintechZoom Com and Why Does It Matter?

- The Importance of Natural Gas Price Prediction

- Factors Influencing Natural Gas Prices

- How FintechZoom Com Helps with Price Prediction

- Long-Tail Keywords and Variations

- Statistical Insights and Market Trends

- Case Studies and Real-World Applications

- Expert Opinions and Industry Insights

- Future Outlook and Long-Term Trends

- Call to Action and Final Thoughts