Payday Loan Apps IPhone: Your Ultimate Guide To Borrowing On The Go

Looking for payday loan apps iPhone solutions? Well, you’ve landed in the right place! Whether you’re dealing with an unexpected car repair, medical bill, or just need some extra cash to tide you over until payday, these apps can be a lifesaver. But hold up—before you dive into the world of payday loans on your iPhone, let’s break down what you need to know. Trust me, this isn’t just about downloading an app; it’s about making smart financial decisions.

Payday loan apps iPhone options have become increasingly popular over the years, and for good reason. They offer convenience, speed, and accessibility, allowing users to borrow money from the comfort of their own homes—or even on the go. But like anything else, there’s a right way and a wrong way to use them. In this guide, we’ll explore everything you need to know about payday loan apps, from how they work to the best options available in 2023.

So grab your iPhone, settle in, and let’s get started. By the end of this article, you’ll not only know which apps to trust but also how to navigate the payday loan landscape like a pro. Let’s make sure you’re borrowing smart, not hard.

Table of Contents

- What Are Payday Loan Apps?

- How Do Payday Loan Apps Work?

- Benefits of Using Payday Loan Apps

- Drawbacks to Consider

- Top Payday Loan Apps for iPhone

- How to Choose the Right App

- Tips for Safe Borrowing

- Common Questions About Payday Loan Apps

- Alternatives to Payday Loan Apps

- Conclusion

What Are Payday Loan Apps?

Alright, let’s start with the basics. Payday loan apps iPhone are mobile applications designed to help users borrow small amounts of money quickly and easily. These apps connect borrowers with lenders who specialize in short-term loans, typically due to be repaid on the borrower’s next payday. Think of it as a quick fix for financial emergencies when you’re short on cash but expect to have funds soon.

But here’s the thing—payday loans aren’t like traditional bank loans. They’re usually unsecured, meaning you don’t need collateral, but they come with higher interest rates and fees. That’s why it’s super important to understand how they work before signing up. And hey, we’ll cover all that juicy info in just a bit.

Why Are Payday Loan Apps Popular?

There are a few reasons why payday loan apps have gained so much traction. First off, they’re super convenient. All you need is a smartphone and an internet connection to apply. Second, they offer quick approval and funding, sometimes within minutes or hours. Lastly, they’re accessible to people who might not qualify for traditional loans due to credit issues or lack of financial history.

That said, popularity doesn’t always equal perfection. We’ll dive deeper into the pros and cons later, but for now, just know that payday loan apps iPhone solutions can be a game-changer—if used wisely.

How Do Payday Loan Apps Work?

Now that you know what payday loan apps are, let’s talk about how they work. The process is pretty straightforward, but it’s essential to understand each step to avoid any surprises down the road.

- Download the App: Most payday loan apps are available on the Apple App Store. Simply search for the app, download it, and create an account.

- Provide Personal Information: You’ll need to share some details, like your name, address, income, and bank account information. Some apps may also require proof of employment or identification.

- Choose a Loan Amount: Once your application is approved, you can select how much you want to borrow. Keep in mind, most payday loans range from $100 to $1,000.

- Receive Your Funds: If approved, the money will typically be deposited into your bank account within a few hours to a few business days, depending on the app.

- Repay the Loan: Payday loans usually have repayment terms of two to four weeks. Some apps allow automatic repayment on your payday, while others let you pay manually.

See? Not too complicated, right? But remember, the ease of borrowing doesn’t mean you should do it lightly. Always read the fine print and make sure you can repay the loan on time to avoid additional fees or penalties.

Benefits of Using Payday Loan Apps

Let’s face it—payday loan apps iPhone solutions come with some serious perks. Here are a few reasons why people love them:

- Convenience: No need to visit a physical location or fill out piles of paperwork. Everything can be done from your phone.

- Speed: Many apps offer same-day approval and funding, making them ideal for urgent financial needs.

- Accessibility: Even if you have bad credit or no credit history, you might still qualify for a payday loan.

- Flexibility: Some apps allow you to borrow small amounts repeatedly, giving you more control over your finances.

But let’s not forget—the convenience of payday loan apps iPhone options comes at a cost. We’ll touch on that in the next section.

Drawbacks to Consider

While payday loan apps sound great in theory, there are some drawbacks you should be aware of. Here’s what you need to watch out for:

- High Interest Rates: Payday loans often come with annual percentage rates (APRs) that can exceed 300%. That’s way higher than most credit cards or personal loans.

- Repayment Pressure: With short repayment terms, you might find yourself struggling to pay back the loan on time, especially if you’re already tight on cash.

- Potential for Debt Cycles: If you can’t repay the loan, you might end up rolling it over or taking out another loan to cover the cost, leading to a cycle of debt.

- Risk of Fraud: Not all payday loan apps are legitimate. Some may charge hidden fees or scam users outright, so it’s crucial to choose a reputable app.

Don’t let these drawbacks scare you off entirely, though. With careful planning and research, you can minimize the risks and use payday loan apps responsibly.

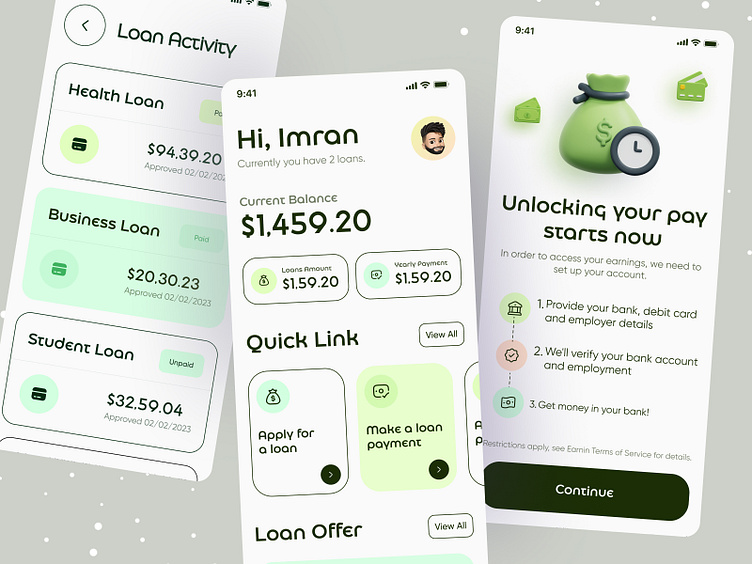

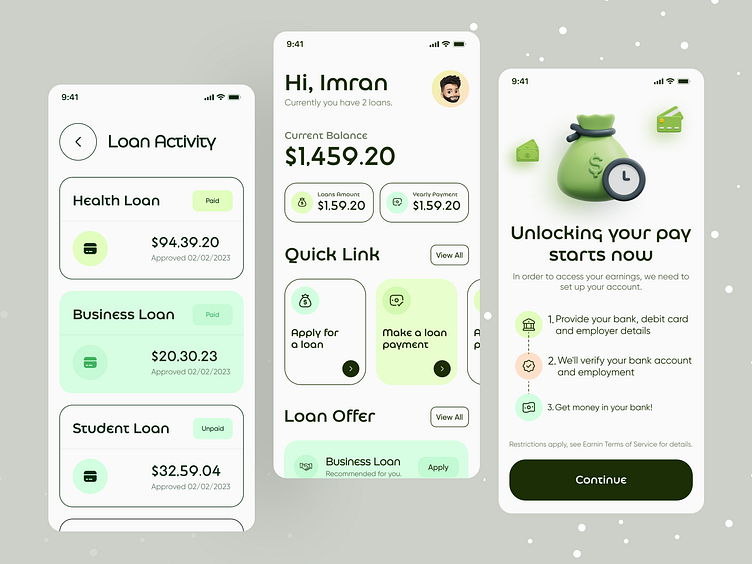

Top Payday Loan Apps for iPhone

Now for the good stuff—here are some of the best payday loan apps available for iPhone in 2023:

1. Cash App

Cash App is more than just a peer-to-peer payment platform. It also offers a feature called “Cash Card,” which allows users to access payday advances. While it’s not a traditional payday loan, it works similarly by letting you borrow against your next paycheck.

2. Earnin

Earnin is another popular app that lets you access your earned wages before payday. Unlike traditional payday loans, Earnin doesn’t charge interest or fees, though they do encourage optional tips. It’s a great option if you want to avoid high costs.

3. Dave

Dave is a subscription-based app that offers “Payday Advance” features. For a small monthly fee, you can borrow up to $100 without interest. It’s a great option for those who want predictable costs and no surprises.

4. LendUp

LendUp is a bit different from other payday loan apps because it offers a loan ladder program. This means you can work your way up to larger loans by repaying smaller ones on time and taking financial education courses. It’s a great way to build credit and improve your financial literacy.

How to Choose the Right App

With so many payday loan apps out there, how do you know which one is right for you? Here are a few tips:

- Read Reviews: Check out user reviews and ratings to see what others are saying about the app.

- Check Fees and Interest Rates: Make sure you understand all the costs involved, including any hidden fees.

- Look for Transparency: A good app will clearly outline its terms and conditions, so you know exactly what you’re getting into.

- Consider Repayment Terms: Choose an app with repayment terms that work with your budget and schedule.

Remember, the right app for you depends on your financial situation and goals. Take your time and don’t rush into anything.

Tips for Safe Borrowing

Using payday loan apps iPhone solutions can be safe if you follow a few simple tips:

- Borrow Only What You Need: Avoid the temptation to borrow more than you can comfortably repay.

- Plan for Repayment: Make sure you have a plan in place to repay the loan on time to avoid fees or penalties.

- Avoid Multiple Loans: Taking out multiple payday loans at once can quickly spiral out of control, so stick to one loan at a time.

- Stay Informed: Keep up with the latest trends and regulations in the payday loan industry to ensure you’re making informed decisions.

By following these tips, you can minimize the risks associated with payday loans and use them as a tool to manage your finances effectively.

Common Questions About Payday Loan Apps

Still have questions? Here are some common ones people ask about payday loan apps:

1. Are Payday Loan Apps Legal?

Yes, payday loan apps are legal in most states, but regulations vary. Some states have strict limits on interest rates and loan amounts, while others have more lenient rules. Always check your state’s laws before applying.

2. Can I Use Payday Loan Apps with Bad Credit?

Absolutely! Many payday loan apps cater specifically to people with bad credit or no credit history. However, keep in mind that interest rates may be higher for these borrowers.

3. How Long Does It Take to Get Approved?

Most payday loan apps offer quick approval, often within minutes. Funding times vary but are typically within a few hours to a few business days.

Alternatives to Payday Loan Apps

Before you commit to a payday loan, consider these alternatives:

- Personal Loans: Personal loans often have lower interest rates and longer repayment terms than payday loans.

- Credit Cards: If you have access to a credit card, you might be able to use it for cash advances or purchases.

- Community Resources: Check out local charities or community organizations that offer financial assistance.

There are plenty of options out there, so take the time to explore what works best for you.

Conclusion

Payday loan apps iPhone solutions can be a helpful tool for managing short-term financial needs, but they’re not without risks. By understanding how they work, choosing the right app, and following safe borrowing practices, you can make the most of these services while avoiding potential pitfalls.

So, what’s next? If you’re considering a payday loan app, do your research, read the fine print, and make an informed decision. And hey, if you found this article helpful, don’t forget to share it with your friends or leave a comment below. Let’s spread the knowledge and help each other navigate the world of personal finance one step at a time.