Apps That Loan Money Until Payday: Your Ultimate Guide To Short-Term Financial Solutions

Feeling stuck between a rock and a hard place when it comes to paying your bills before payday? You're not alone. Millions of people face this exact dilemma every month, and that's where apps that loan money until payday come into play. These digital platforms have revolutionized how we access short-term financial assistance, making it faster and more convenient than ever before. Whether you need cash for groceries, rent, or an unexpected emergency, these apps are designed to help you stay afloat without the hassle of traditional loans.

But hold up—before you dive headfirst into borrowing money, it's important to understand how these apps work and what they offer. In this article, we'll break down everything you need to know about apps that loan money until payday, including the pros and cons, key features, and tips for choosing the right one. Think of it as your personal cheat sheet to navigating the world of payday loan apps.

From understanding interest rates to exploring alternative options, we've got you covered. By the end of this read, you'll be equipped with the knowledge to make informed decisions about your finances. So grab a cup of coffee, get comfortable, and let's dig in!

Table of Contents

- Introduction to Apps That Loan Money Until Payday

- How These Apps Work

- Types of Loans Offered

- Benefits of Using Payday Loan Apps

- Risks and Challenges

- Top Apps That Loan Money Until Payday

- Tips for Choosing the Right App

- Alternative Options to Consider

- Regulations and Legal Considerations

- Conclusion and Final Thoughts

Introduction to Apps That Loan Money Until Payday

Let's face it—life can throw curveballs when you least expect them. Whether it's a sudden car repair or an unexpected medical bill, these situations often require immediate cash, and not everyone has the luxury of a savings cushion. Enter apps that loan money until payday. These digital platforms are designed to provide quick access to small loans, typically ranging from $100 to $1,000, to help bridge the gap until your next paycheck.

What makes these apps so appealing is their convenience and speed. Unlike traditional banks, which might take days or even weeks to process loan applications, these apps often approve loans within minutes and deposit the funds directly into your account. It's like having a financial safety net at your fingertips. However, it's crucial to approach these apps with caution, as they often come with high interest rates and fees.

Why Are These Apps Becoming Popular?

There are several reasons why payday loan apps are gaining traction. First, they cater to a demographic that traditionally struggles to access credit through conventional means. Second, the rise of mobile technology has made it easier than ever to apply for loans on the go. Lastly, the simplicity of the process appeals to users who want hassle-free solutions to their financial woes.

How These Apps Work

So, how exactly do apps that loan money until payday operate? Here's a quick rundown of the typical process:

- Download the app and create an account.

- Provide basic personal information, such as your name, address, and income details.

- Link your bank account to verify your financial status.

- Apply for the loan amount you need.

- Wait for approval, which usually happens within minutes.

- Receive the funds directly into your bank account.

- Repay the loan on your next payday, either automatically or manually.

While the process seems straightforward, it's important to read the fine print. Some apps may charge hidden fees or have strict repayment terms, so always review the terms and conditions carefully before signing up.

Key Features to Look For

When evaluating payday loan apps, here are some features to consider:

- No credit check: Some apps offer loans without requiring a credit score check, making them accessible to people with poor credit.

- Flexible repayment options: Look for apps that allow you to extend repayment terms if needed.

- Transparency: Ensure the app clearly outlines all fees and interest rates upfront.

- Customer support: A responsive customer service team can make all the difference if issues arise.

Types of Loans Offered

Not all payday loan apps are created equal. Some specialize in specific types of loans, while others offer a range of options. Here are the most common types of loans you'll encounter:

Traditional Payday Loans

These are the classic short-term loans that are repaid on your next payday. They typically come with higher interest rates and are best suited for small, one-time expenses.

Installment Loans

Installment loans allow you to repay the borrowed amount over several payments, making them more manageable for larger expenses. These loans often have lower interest rates compared to traditional payday loans.

Line of Credit

Some apps offer a line of credit, which works like a credit card. You can borrow up to a certain limit and only pay interest on the amount you use. This option is great for recurring expenses or emergencies.

Benefits of Using Payday Loan Apps

While payday loan apps aren't without their drawbacks, they do offer several advantages:

- Speed: Funds are often deposited within hours of approval.

- Convenience: You can apply from anywhere using your smartphone.

- No credit check: Many apps don't require a credit score, making them accessible to everyone.

- Flexibility: Some apps offer multiple loan options to suit different needs.

These benefits make payday loan apps an attractive option for people in urgent need of cash. However, it's important to weigh these advantages against the potential risks.

Risks and Challenges

As with any financial product, there are risks associated with using payday loan apps. Here are a few to watch out for:

- High interest rates: Many apps charge exorbitant interest rates, which can quickly add up if you're unable to repay on time.

- Hidden fees: Some apps sneak in additional charges that aren't immediately obvious.

- Debt cycle: Borrowing frequently can lead to a cycle of debt that's difficult to break.

- Scams: Unfortunately, not all apps are legitimate, so it's essential to do your research before signing up.

To minimize these risks, always read reviews, check for official certifications, and compare multiple apps before making a decision.

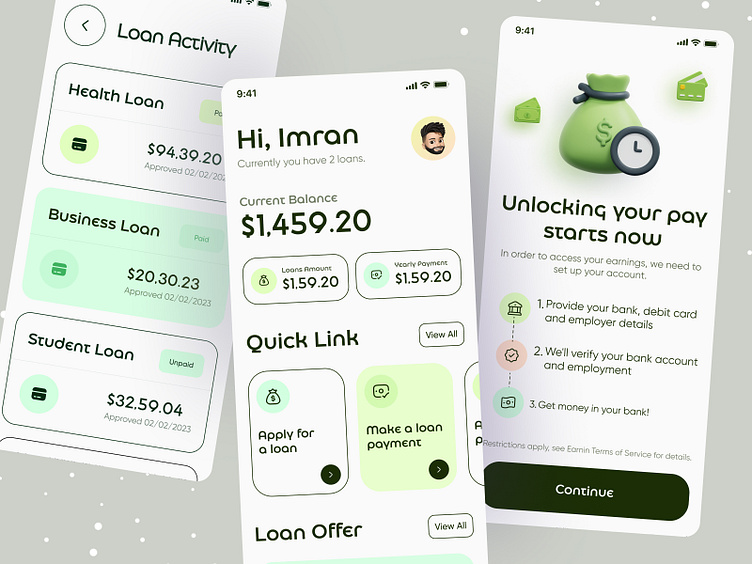

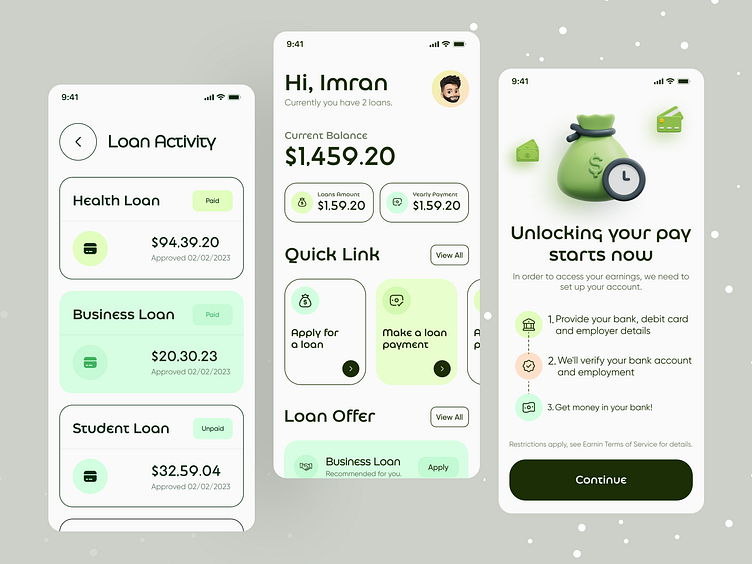

Top Apps That Loan Money Until Payday

Now that you know the ins and outs of payday loan apps, let's take a look at some of the best options available:

1. Cash App

Cash App offers a "Cash Boost" feature that allows users to access small loans with competitive interest rates. The app is user-friendly and integrates seamlessly with other financial services.

2. Earnin

Earnin lets you access your earned wages early without charging interest. Instead, they encourage voluntary tips from users who find the service helpful.

3. Brigit

Brigit provides overdraft protection and small loans with no interest charges. They focus on helping users build better financial habits through budgeting tools.

4. Dave

Dave offers a "Cash Advance" feature that allows users to access up to $100 without interest. They also provide financial literacy resources to empower users.

5. WageCan

WageCan lets you access a portion of your earned wages before payday. The app charges a small fee for each withdrawal, but no interest.

Tips for Choosing the Right App

With so many payday loan apps to choose from, how do you pick the best one for your needs? Here are some tips to guide you:

- Read user reviews to gauge the app's reliability and customer service.

- Compare interest rates and fees across multiple apps to find the most affordable option.

- Check for security features, such as encryption and two-factor authentication.

- Look for apps that align with your financial goals and habits.

Remember, the right app for you may not be the same as the one that works for someone else. Take the time to evaluate your options carefully.

Alternative Options to Consider

While apps that loan money until payday can be helpful in a pinch, there are alternative solutions worth exploring:

1. Personal Loans

Personal loans from banks or credit unions often come with lower interest rates and more flexible terms. If you have decent credit, this could be a better option.

2. Credit Cards

Using a credit card for emergencies can be a viable alternative, especially if you have a low-interest card. Just be sure to pay off the balance promptly to avoid accumulating debt.

3. Borrowing from Friends or Family

While it may feel awkward, borrowing from loved ones can be a cost-effective solution. Just make sure to set clear repayment terms to avoid misunderstandings.

4. Budgeting Apps

Apps like Mint or YNAB can help you manage your finances better, reducing the need for short-term loans in the first place.

Regulations and Legal Considerations

Payday loan apps operate within a complex regulatory landscape. In some countries, they are heavily restricted or even banned due to concerns about predatory lending practices. It's crucial to familiarize yourself with the laws in your region before using these apps.

Additionally, always verify that the app you choose is licensed and compliant with local regulations. This ensures that your personal and financial information is protected and that the app operates ethically.

Conclusion and Final Thoughts

In conclusion, apps that loan money until payday can be a lifesaver in times of financial need. They offer convenience, speed, and accessibility that traditional loans often lack. However, they also come with risks, such as high interest rates and the potential for debt cycles.

By doing your research, comparing options, and using these apps responsibly, you can make the most of their benefits while minimizing the downsides. Remember, short-term loans should be a last resort, and it's always a good idea to explore alternative solutions whenever possible.

So, what are you waiting for? Take control of your finances today and find the app that works best for you. And don't forget to share this article with friends who might find it helpful. Together, we can empower each other to make smarter financial decisions!